A Historic Bull Market

Yesterday the current stock market made history by becoming the longest-running bull market in history. The US economy is proving stronger than all the many headwinds that might threaten it. All this despite the fact that the Dow recently registered its longest streak in "correction" territory in 60 years. Also noteworthy is the fact that the US manufacturing index is at a nine-month low.

It seems counter-intuitive. Even whether or not this is the longest bull market is questionable. Barron's, not exactly a liberal journal, makes a strong case that this isn't the longest bull market at all. This chart indicates that there were four previous bull markets with a duration in excess of 12 years and our bull market is only 9+ years thus far. In some ways the present bullish run isn't that exceptional at all.

In truth it doesn't matter. This bull market is strong in itself and compared with history (see these interesting comparison articles here and here and here and here). There are a lot of people making a lot of money in their retirement accounts and otherwise recently. Even though the bull run started in President Obama's first year in office (2009) the strong economy and bullish stock markets are a big "win" for Donald Trump. I keep hearing the word "Trumponomics" used over and over again by people I talk to. The cult of Trump engulfs the entire American economic surge as if he were personally responsible for all of it, which he is not. Regardless, Trump benefits from the strong economy as much as the average investor, if not more so.

My own exposure to this rising tide has been cautiously minimal, though I have increased my positions in various mutual funds over the past 12 months. I am dollar cost averaging in at the moment but not that much as the longevity of the market also makes its correction more imminent.

But my previous interpretation that the market correction that began in February might be a harbinger of a bear market was probably premature. It seems that this bull still has a lot of legs under it and could run to record levels by the end of the year. I am comfortable with my market exposure at this time. Things seem to be going great for the economy.

But all is not well. According to Forbes our "real economy" isn't booming at all. 12% of employed Americans are considered "poor" even though they have a job. Healthcare costs are predicted to rise 20% in the next year, which will put a strain on both employees and employers. Credit card debt has fueled much of the economic growth but it is now reaching the upper limits of servicing the debt - at over $1 trillion. College student debt tops even credit card debt.

Perhaps most importantly, wage growth in the US is at an anemic 2.9% annually. It is difficult to see how the American consumer can continue recent spending patterns, dramatically increasing personal debt, with such low wage growth. Debt is rising at a far greater rate than income. That is obviously unsustainable, even if the tipping point still lies in the future.

Traditionally, I have relied upon Dow Theory to determine where we are in terms of investing in the markets. But recently I came across an article that shows another metric that I am now taking seriously, given its excellent historical record.

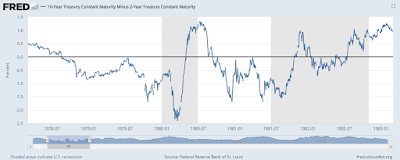

This involves subtracting the 2-year treasury rate from the 10-year treasury. I have read about this useful comparison before but only recently paid closer attention to it. The St. Louis Federal Reserve tracks this in an interactive map available on their website. This graph shows that every economic recession going back to 1980 has been proceeded by higher short-term rates than long-term rates. Here are some screenshots of examples:

According to this graph, we are nearing (but not yet close) to a recession. It should be noted that even when the graph turns negative it could take over a year for a recession to actually occur. I'm fairly sure this is one indicator economists look at when peering into the murky crystal ball of economic prediction. And the present trajectory is in line with Ben Bernanke's recent prediction of a recession in 2020.

So, even though the specifics of short-term economic growth seem positive and the markets might not act as robustly as investors have come to expect post-2009 or during the first year of the Trump presidency, it looks overall as if investors are safe maintaining their positions for the next few months.

Whether nor not this bull market is truly historic in terms of its longevity, it nevertheless displays solid strength and likely will continue to make money for investors probably beyond 2018. This is a positive sign for those of us creating wealth through investment (even though I failed to leverage in as much as I should have in hindsight). Despite the politics of the situation, the markets are doing what they are supposed to do; balancing out certainty and uncertainty, discounting negative factors that are relevant while rallying on factors that seem important.

I will bet on the action of the 10-year and 2-year treasuries and conclude there is still money to be made, regardless of the conflicting news and data we are exposed to every day. No one knows for sure what is going to happen, including me. I am cautious. But according to the treasury metric, things should remain more positive than negative for months to come.

Late Note: Strictly in terms of Dow Theory, the Dow Transports reached an all-time two days ago. Since then they have backed off a bit. The Dow Industrial Average is near the all-time high it reached back in January. Likewise it backed off the last two sessions. If the Industrials can match the new high of the Transports then we will have a Dow Theory Bull confirmation. Until that happens, this correction remains in force (according to Dow Theory) and the bullishness is in question.

It seems counter-intuitive. Even whether or not this is the longest bull market is questionable. Barron's, not exactly a liberal journal, makes a strong case that this isn't the longest bull market at all. This chart indicates that there were four previous bull markets with a duration in excess of 12 years and our bull market is only 9+ years thus far. In some ways the present bullish run isn't that exceptional at all.

In truth it doesn't matter. This bull market is strong in itself and compared with history (see these interesting comparison articles here and here and here and here). There are a lot of people making a lot of money in their retirement accounts and otherwise recently. Even though the bull run started in President Obama's first year in office (2009) the strong economy and bullish stock markets are a big "win" for Donald Trump. I keep hearing the word "Trumponomics" used over and over again by people I talk to. The cult of Trump engulfs the entire American economic surge as if he were personally responsible for all of it, which he is not. Regardless, Trump benefits from the strong economy as much as the average investor, if not more so.

My own exposure to this rising tide has been cautiously minimal, though I have increased my positions in various mutual funds over the past 12 months. I am dollar cost averaging in at the moment but not that much as the longevity of the market also makes its correction more imminent.

But my previous interpretation that the market correction that began in February might be a harbinger of a bear market was probably premature. It seems that this bull still has a lot of legs under it and could run to record levels by the end of the year. I am comfortable with my market exposure at this time. Things seem to be going great for the economy.

But all is not well. According to Forbes our "real economy" isn't booming at all. 12% of employed Americans are considered "poor" even though they have a job. Healthcare costs are predicted to rise 20% in the next year, which will put a strain on both employees and employers. Credit card debt has fueled much of the economic growth but it is now reaching the upper limits of servicing the debt - at over $1 trillion. College student debt tops even credit card debt.

Perhaps most importantly, wage growth in the US is at an anemic 2.9% annually. It is difficult to see how the American consumer can continue recent spending patterns, dramatically increasing personal debt, with such low wage growth. Debt is rising at a far greater rate than income. That is obviously unsustainable, even if the tipping point still lies in the future.

Traditionally, I have relied upon Dow Theory to determine where we are in terms of investing in the markets. But recently I came across an article that shows another metric that I am now taking seriously, given its excellent historical record.

This involves subtracting the 2-year treasury rate from the 10-year treasury. I have read about this useful comparison before but only recently paid closer attention to it. The St. Louis Federal Reserve tracks this in an interactive map available on their website. This graph shows that every economic recession going back to 1980 has been proceeded by higher short-term rates than long-term rates. Here are some screenshots of examples:

|

| The comparison remained positive for about 7 years until it once again registered negative around the beginning of 1989, a harbinger of the 1990 recession which again started about 18 months later. |

|

| The 2001 recession was preceded by a negative downturn in the treasury comparison in early 2000. |

|

| The Great Recession was preceded by the comparison skipping along negative territory in 2006 and 2007. |

According to this graph, we are nearing (but not yet close) to a recession. It should be noted that even when the graph turns negative it could take over a year for a recession to actually occur. I'm fairly sure this is one indicator economists look at when peering into the murky crystal ball of economic prediction. And the present trajectory is in line with Ben Bernanke's recent prediction of a recession in 2020.

So, even though the specifics of short-term economic growth seem positive and the markets might not act as robustly as investors have come to expect post-2009 or during the first year of the Trump presidency, it looks overall as if investors are safe maintaining their positions for the next few months.

Whether nor not this bull market is truly historic in terms of its longevity, it nevertheless displays solid strength and likely will continue to make money for investors probably beyond 2018. This is a positive sign for those of us creating wealth through investment (even though I failed to leverage in as much as I should have in hindsight). Despite the politics of the situation, the markets are doing what they are supposed to do; balancing out certainty and uncertainty, discounting negative factors that are relevant while rallying on factors that seem important.

I will bet on the action of the 10-year and 2-year treasuries and conclude there is still money to be made, regardless of the conflicting news and data we are exposed to every day. No one knows for sure what is going to happen, including me. I am cautious. But according to the treasury metric, things should remain more positive than negative for months to come.

Late Note: Strictly in terms of Dow Theory, the Dow Transports reached an all-time two days ago. Since then they have backed off a bit. The Dow Industrial Average is near the all-time high it reached back in January. Likewise it backed off the last two sessions. If the Industrials can match the new high of the Transports then we will have a Dow Theory Bull confirmation. Until that happens, this correction remains in force (according to Dow Theory) and the bullishness is in question.

Comments